ModernAdvisor is a Vancouver-based fintech and robo-advisor.

Unlike most investment apps, ModernAdvisor is not available to the general public without an invitation from a financial planner or a referral from a friend.

In other words, you can’t simply head to the ModernAdvisor website and open a new account.

This limitation clearly places ModernAdvisor at a disadvantage when compared to other leading Canadian robo-advisors, such as Wealthsimple, Questwealth or JustWealth. But, if you are one of the select few with the opportunity to deal with ModernAdvisor, you may wonder if it’s worth considering.

Who is ModernAdvisor best for?

✅ ModernAdvisor is best suited for Canadian investors who deal with a financial planner (with access to ModernAdvisor) and would like a low-cost managed investing option for at least part of their investment portfolio.

❌ ModernAdvisor is not ideal for self-directed investors who want full control over their investment decisions and the ability to place their own trades.

ModernAdvisor offers the following investment account types:

- Taxable accounts (individual and joint)

- RRSP

- Spousal RRSP

- RRIF

- TFSA

- Individual RESP

- LIRA

- FHSA

- RDSP

NOTE: Corporate accounts are also available, however, they must be opened manually by a ModernAdvisor representative.

ModernAdvisor pros and cons

Pros

-

Fees are competitive with other robo-advisor platforms

-

Supports many different account types

-

Socially responsible investment (SRI) options available

-

Passive and actively managed portfolios are available

Cons

-

Not available to the general public

-

Minimum investment per account of $1,000

-

0.20% management fee on passive high interest savings portfolios

ModernAdvisor fees and commissions

ModernAdvisor charges a management fee on a percentage of assets under management (AUM), with rates varying depending on the type of portfolio you hold. Not surprisingly, the passively managed portfolios have the lowest fees:

| Portfolio | Investing style | Management fee |

|---|---|---|

| Core ETF | Passive | 0.40% |

| Socially responsible ETFs | Passive | 0.40% |

| Harmony portfolios | Mix of passive and active management | 0.70% or less |

| High interest savings portfolios | Passive | 0.20% |

| BCV portfolios | Active | 0.90% |

Generally, these fees are competitive with other robo-advisor platforms. For example, Wealthsimple charges 0.40% to 0.50% depending on the amount you have invested. You can get as low as 0.25% and 0.20% with Questwealth from Questrade.

ModernAdvisor does not charge any commission fees on its ETFs or any monthly or annual service fees.

Note that ModernAdvisor’s management fees (listed above), while reasonable, are over and above fund fees (MERs), and any fees that you are paying to the referring financial planner. According to Wealth Professional Canada1, financial planners typically charge yearly fees of around 1% of your assets.

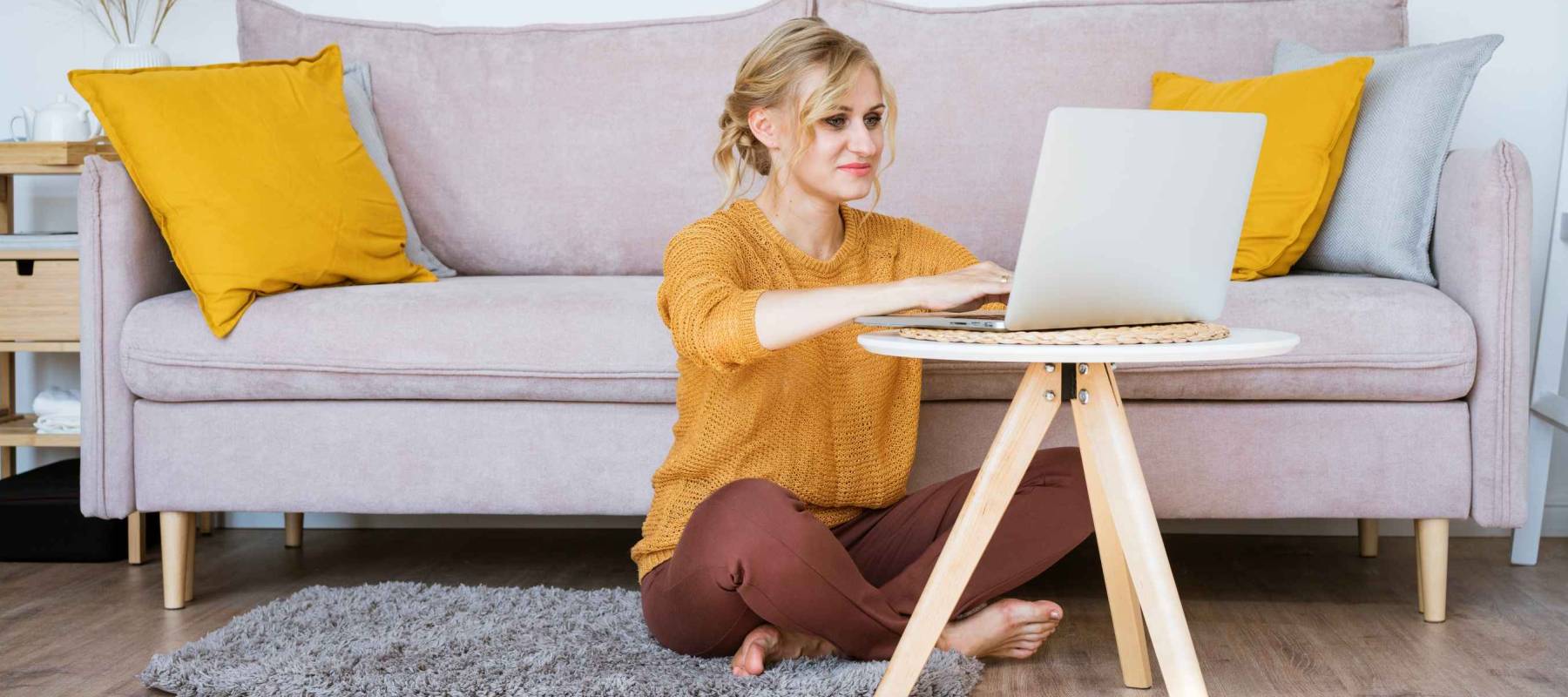

ModernAdvisor app and platform

ModernAdvisor has a clean user interface that translates well on both desktop and mobile devices. The account summary screen makes it easy to view your portfolio balance, earnings and rate of return, as well as your portfolio’s asset allocation.

ModernAdvisor allows you to modify your account inside the app. You can set your investment goal and timeframe, targeted savings goal and your risk tolerance. ModernAdvisor will use this information to determine an appropriate asset allocation.

We opened up a trial ModernAdvisor account, back in 2019, and had a look at what the platform looks like and how this robo advisor goes about advising on the trial investments.

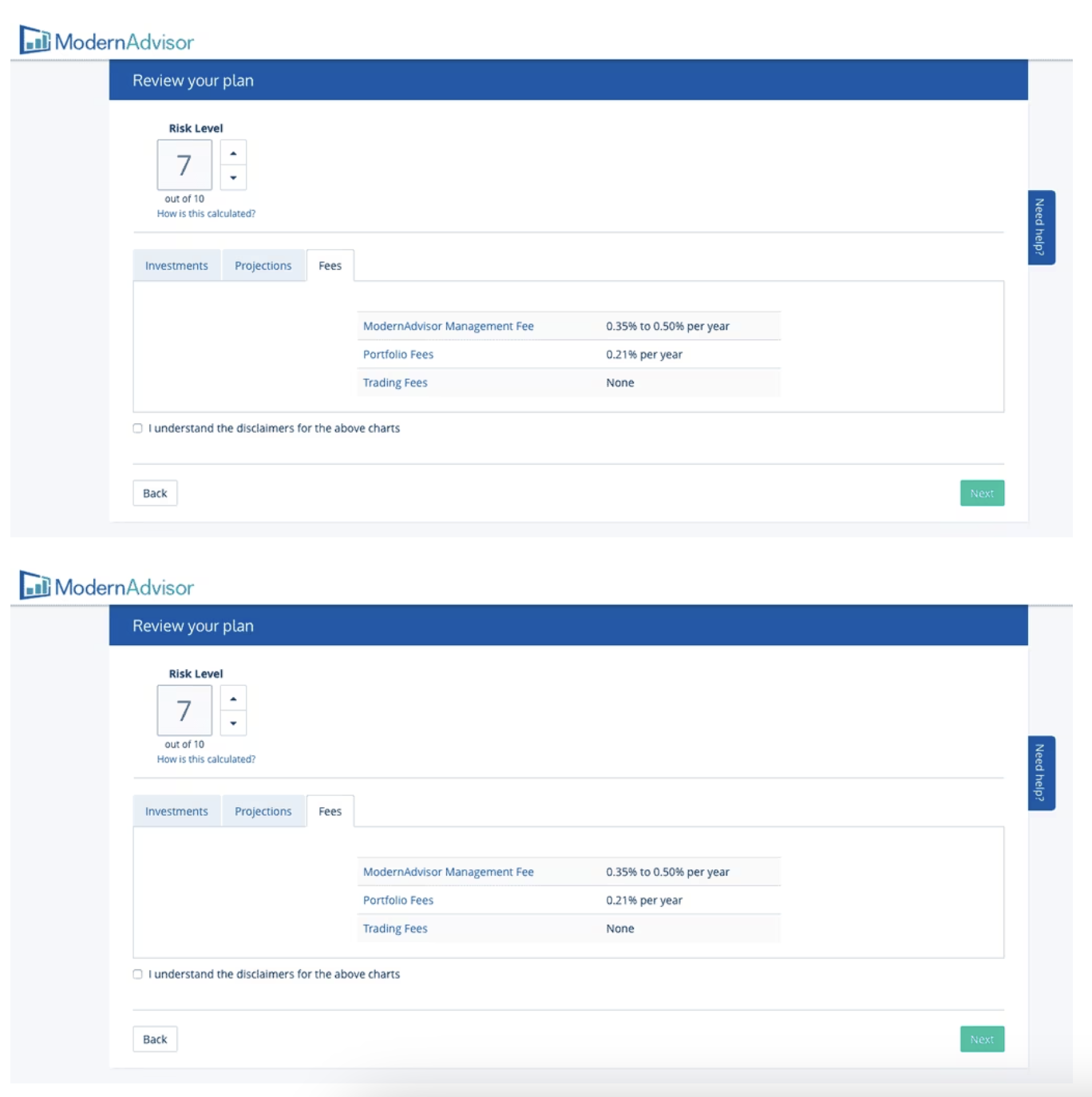

First off, ModernAdvisor started by understanding my risk tolerance, my age, the amount I wanted to invest, and what my goals were.

A few pictures below show screenshots of the assessment of my investing personality and my risk level. They deemed my risk level to be moderate and created an ETF portfolio to match my level of risk.

Then it summarizes my investment style, I am deemed “moderate”.

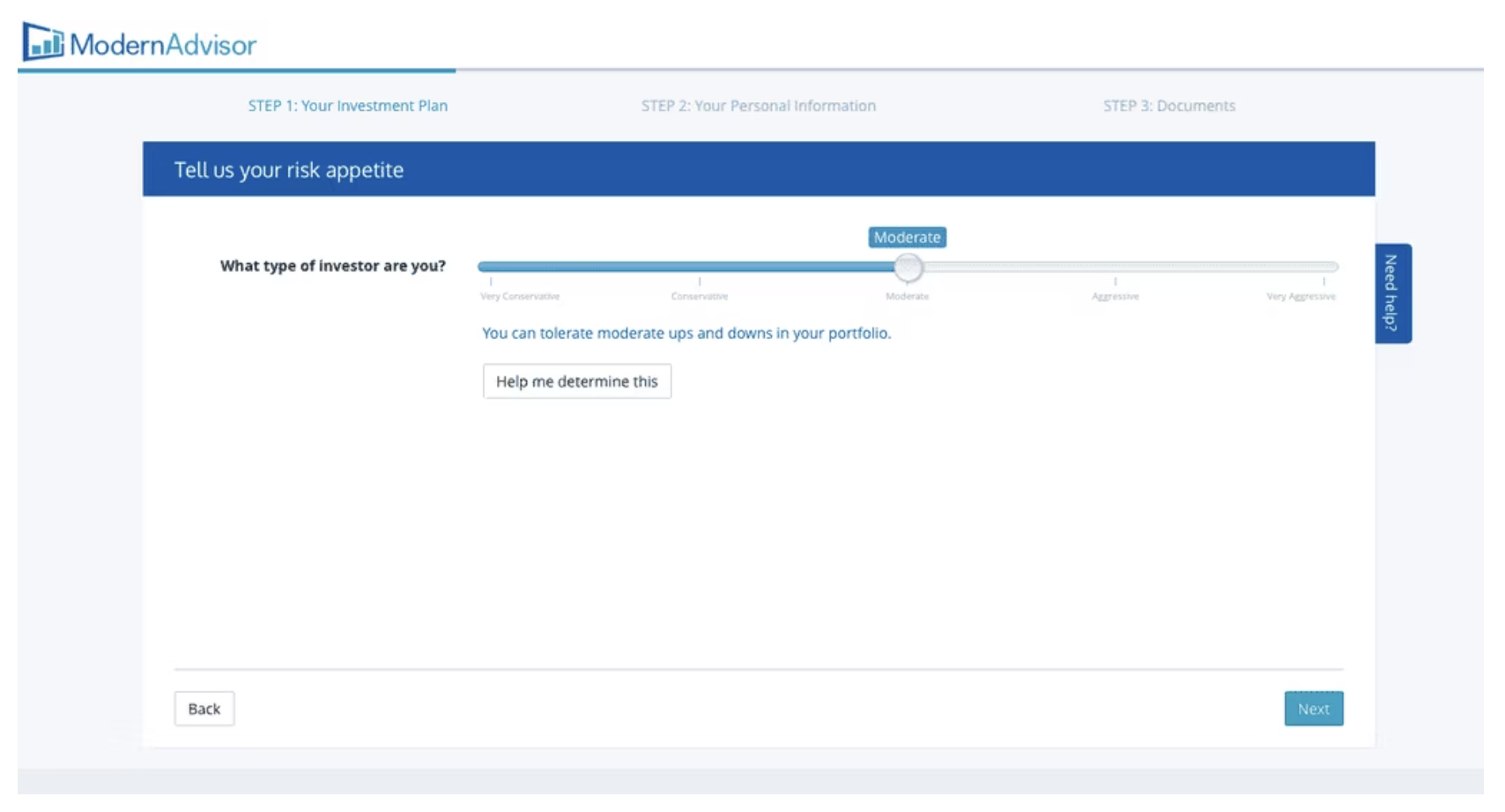

After understanding the risk tolerance, inputting my free $1,000, and answering a few more questions (it didn’t take very long, I think under 15 minutes or so). Afterwards, the money I invested in the trial account is allocated to the varying ETFs in the portfolio created based on my risk level. The low-fee Exchange-Traded Funds that ModernAdvisor uses are a select few and have a mirror image of the socially responsible Exchange-Traded Fund they use for those who want to invest via socially responsible means.

Research and education

Like most robo-advisors, ModernAdvisor lacks the research tools and market data most self-directed trading platforms offer. However, you can access portfolio information on its website, and its Help Centre has dozens of articles with answers to common questions. Customers can also ask questions to on-demand advisors within the app at any time.

Customer service and support

If you have questions, you can contact ModernAdvisor by telephone at 1-888-365-0075 or by email at [email protected]. Customers can also ask questions to on-demand advisors within the app at any time.

What I like (and don’t) about ModernAdvisor

ModernAdvisor has a few things going for it, and one major drawback.

First, the positives.

I like the simplicity of the platform. From the paperless account opening process to the clean and well-designed user interface, it looks and feels like a modern robo-advisor should. At the same time, it offers several account types, including Spousal RRSPs, RESPs, RDSPs and FHSA accounts. And, its fees are similar to what you would pay with Wealthsimple or JustWealth.

But the big caveat to all of this is that ModernAdvisor is not available to most Canadians.

You can only open an account if you are provided with a referral code from your financial planner or a friend who already deals with ModernAdvisor. This wasn’t always the case, and I’m unsure why the company decided to make the change and limit its services to specific clientele. If you are interested in ModernAdvisor and you think you might have access through your financial planner, it’s definitely worth checking out.

Otherwise, check out our list of the best robo-advisors in Canada.

ModernAdvisor compared

Modernadvisor vs. Wealthsimple

Wealthsimple is Canada’s largest robo-advisor. Like ModernAdvisor, it offers a wide range of investment portfolio options, including SRI portfolios. Its management fees, which range from 0.50% to 0.40% (portfolios $100,000) are comparable to ModernAdvisor, but Wealthsimple is much more accessible.

Unlike ModernAdvisor, which uses financial planners and its existing clients as gatekeepers for its platform, anyone who meets the eligibility requirements can sign up with Wealthsimple online within a few minutes. For this reason, I cannot recommend ModernAdvisor over Wealthsimple.

Wealthsimple now offers free financial advisors to anyone with an account over $100,000.

ModernAdvisor vs. JustWealth

Like Wealthsimple, JustWealth is a longstanding Canadian robo-advisor platform, and on our list of top Canadian robo-advisors. It offers a wide range of portfolios and its management fees are competitive. But where JustWealth really shines is with its RESP products, offering clever, target-date RESP portfolios and no RESP account minimums.

If you are starting with a small investment amount and are not planning to buy RESPs, ModernAdvisor might be a better fit. Its account minimum of $1,000 is less than the standard JustWealth account minimum of $5,000.

ModernAdvisor vs. TD Easy Trade™

TD Easy Trade™ is a mobile-only self-directed trading platform offered by TD Direct Investing and geared to newer investors. It offers up to 50 commission-free stock and ETF trades annually, with no annual or monthly fees. Accounts types are limited to non-registered, RRSP and TFSA, and you can only select from TD’s family of ETFs (sorry, no Vanguard or iShares).

Unlike TD Easy Trade, you can’t trade individual stocks with ModernAdvisor, but you can buy low-cost, fully managed portfolios, something TD Easy Trade does not offer. If you prefer a hands-off approach to investing, stick with ModernAdvisor. If you want access to free stock trades and don’t mind placing your own trades, consider TD Easy Trade.

- ModernAdvisor was cofounded by Navid Boostani and Adrian Brouwers.

- Navid Boostani is the CEO of ModernAdvisor. He has a background in electromechanical engineering and got his credentials as a CFA (Certified Financial Analyst) a few years later.

- Credential Securities Inc. (“Credential”) holds your assets and accounts and ModernAdvisor acts as a broker-dealer. Credential is Canadian-owned; the Provincial Credit Union Centrals own 50%.

- Many investment dealers and credit unions use Credential to hold their clients’ investment accounts, execute trades, provide tax reporting and other back-office account administration.

- Credential safeguards over $20 billion for Canadian financial institutions and is a member of the Investment Industry Regulatory Organization of Canada IIROC and the Canadian Investor Protection Fund CIPF

ModernAdvisor is registered as a Restricted Portfolio Manager with the securities commissions of all provinces in Canada and the Northwest Territories. You can check the registration of investment managers here. As a Portfolio Manager ModernAdvisor is held to a fiduciary standard. This is a pretty big deal in Canada because it means that legally the company must put your best interests first – a legal standard that someone who gives themselves the title “Money Coach” or “Financial Advisor” does not have to meet.

Every company has a different type way of automatically re-balancing your investment dollars. For ModernAdvisor, they automatically re-balance your asset allocation if there is more than a 5% difference from the original investment.

So there isn’t a scheduled time when you are supposed to see that your Robo Advisor is rebalancing your investment portfolio, but it will happen automatically whenever there is an absolute difference of 5% (high or lower) from the original investment.

Basically, the robo is there to keep your risk profile the same as the one you first decided on. You don’t want stocks or bonds to become too large a percentage of your portfolio, so they automatically sell a bit of one asset class (usually a class that is doing well) to purchase more of another asset class (usually one that is doing relatively poorly).

- XIC- iShares Core S&P/TSX Capped Composite Index ETF

- XEN- iShares Jantzi Social Index ETF

- VUS- Vanguard US Total Market ETF (Canadian dollar hedged)

- DSI- iShares MSCI KLD 400 Social ETF

- VEF- Non-North American Developed Market ETF (Canadian dollar hedged)

- VEE- Vanguard Emerging Markets ETF

- VSB- Vanguard Canadian Short-Term Bond

- CLF- iShares 1-5 Year Laddered Government Bond Index ETF (no corporate bonds, only government bonds, the socially responsible alternative to VSB)

- ZEF- BMO Emerging Markets Bond (Canadian Index hedged), invests in bonds from countries such as South Korea, Russia, Mexico and Indonesia

- VRE- Vanguard Canadian Capped REITs Index ETF (Real Estate Investment Trusts)- the interesting thing here is that they have very low assets under management, only $94 million. ModernAdvisor states that they use this particular ETF because it is the least costly one available.

FAQ

Colin Graves is a Winnipeg-based financial writer and editor whose work has been featured in publications such as Time, MoneySense, MapleMoney, Retire Happy, The College Investor, and more. Before becoming a full-time writer, Colin was a bank manager for over 15 years.

Best investing content

How to...

Investment battles

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.