BMO SmartFolio review

Money.ca / Money.ca

Updated: April 17, 2025

The robo-advisor landscape in Canada is highly competitive, with brands such as Wealthsimple, Justwealth and Questwealth offering investors low prices and a long list of features. As a big-bank robo-advisor, BMO SmartFolio provides stability and an excellent online platform and mobile app. But with higher fees and limited ETF selection, is it enough to entice non-BMO clients? Find out in my full BMO SmartFolio review.

What is BMO SmartFolio?

BMO SmartFolio is a digital investing platform offered by BMO Nesbitt Burns, the investment division of BMO, one of Canada’s Big 6 Banks. When it launched in 2016, it was the first big-bank robo-advisor in Canada.

SmartFolio offers fully managed model investment portfolios that are comprised of low-cost ETFs. It’s designed for beginner investors and those seeking a hands-off, online investing solution. With a minimum investment of $1,000, you can open an account online and set up regular contributions from your primary bank account. You can also transfer cash from an account with another investment firm.

Unlike most Canadian robo-advisors, BMO uses its own family of proprietary ETFs for its Smartfolio portfolios. This means that BMO professionals are not only overseeing your portfolio, but also the underlying investments.

Key features:

- Online robo-advisor investing

- Hands-off investing with model ETF portfolios

- Low management fees ranging from 0.40% to 0.70%

- Fees are based on household assets

- Registered and non-registered account options available

- Automatic rebalancing

- Minimum investment of $1,000

Who should use BMO SmartFolio?

BMO SmartFolio is best suited for existing BMO customers who want a managed investment solution without moving their money to an outside platform. It’s also ideal for new investors looking for a passive investing strategy and who value BMOs standing as one of Canada’s largest financial institutions.

SmartFolio is not ideal for self-directed investors who want more control over their investments, including placing their own trades.

BMO SmartFolio pros and cons

- Fully managed investing solution with professional oversight

- BMO is a trusted Canadian financial institution with a long history

- Smartfolio integrates well with BMO banking accounts

- Portfolios are automatically rebalanced to maintain target asset allocation

- ETFs are lower-cost investments than mutual funds

- Higher fees than Wealthsimple, Questwealth Portfolios and Justwealth

- ETF selection is limited to BMO funds (no Vanguard or iShares)

- Socially responsible investing (SRI) portfolios not offered

BMO SmartFolio Portfolios: Which one fits your investing goals?

*Actual asset allocations may differ slightly due to cash and cash equivalents holdings.

When you open a SmartFolio account, you’ll be asked a series of questions that help BMO understand your investment objectives and risk tolerance. They use this information to match you with a suitable portfolio.

The beauty of robo-advisors like SmartFolio is that once you’re invested, your portfolio is monitored 24/7 by a team of BMO investment professionals. One way they do this is by automatically rebalancing your portfolio to maintain your target asset allocation. As you know, the stock market is constantly fluctuating. If an asset class rises in value, adjustments will be made to maintain the correct balance.

BMO SmartFolio fees: What will it cost you?

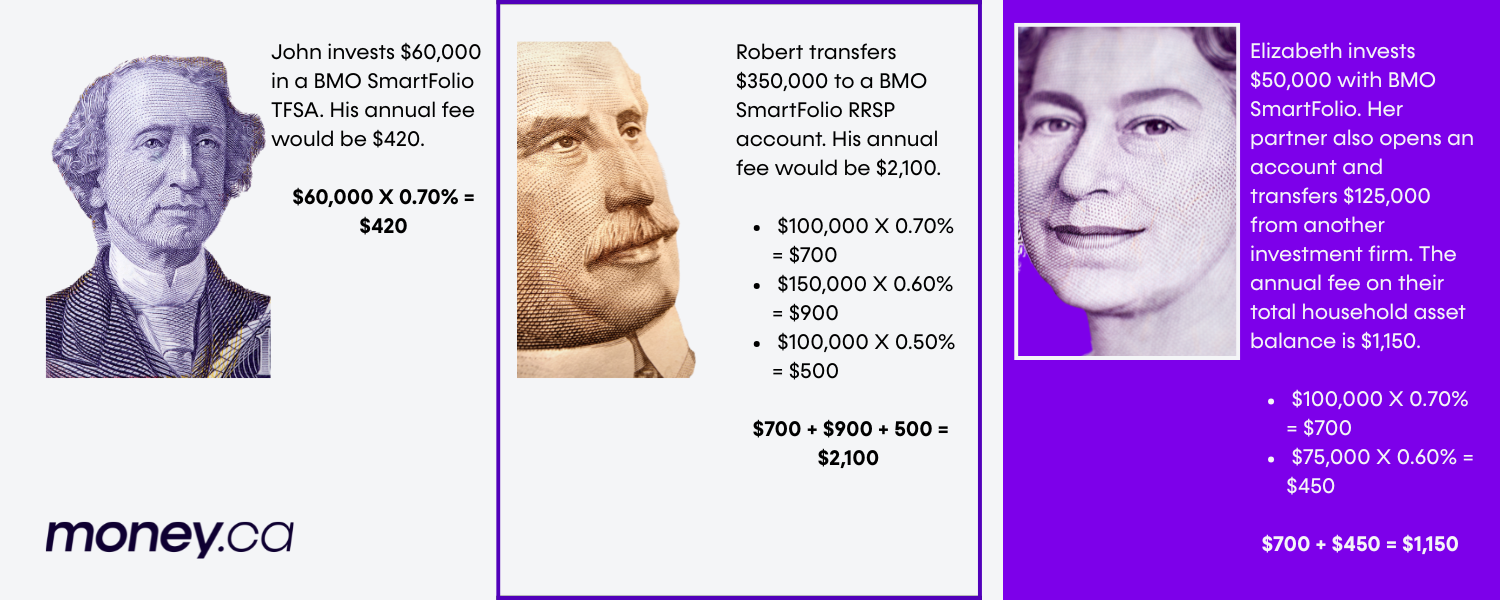

BMO SmartFolio offers simple, transparent pricing, with fees that drop as your asset value grows. Here’s a breakdown of the fee schedule:

*Accounts can be grouped by household to minimize fees.

Fee examples:

Additional fees

In addition to the annual management fee, the ETFs held in each portfolio incur MER fees, which range between 0.20% and 0.35% of the value held in each ETF. MERs are standard charges for any investment fund, including ETFs and mutual funds.

How do BMO SmartFolio fees compare?

When compared to other leading Canadian robo-advisor platforms, BMO SmartFolio’s management fees are on the higher end.

For example, Wealthsimple Invest’s fees start at 0.50% for portfolios up to $100,000 before dropping to 0.40%. You can even get fees as low as 0.20%, but you must invest $10 million or more.

Justwealth charges 0.50% on the first $500,000 and 0.40% above $500,000. Their accounts charge a minimum $4.99 monthly management fee, except for RESP and FHSA accounts.

BMO SmartFolio performance: How do returns stack up?

Here is a snapshot of SmartFolio’s average annual investment returns since the portfolios were launched in 2016. Remember that past performance is not an indicator of future results.

*All portfolios' inception date is January 31, 2016, except for the Capital Preservation Portfolio (April 30, 2016).

BMO SmartFolio portfolios use a passive investing strategy, meaning they invest in exchange-traded funds or ETFs. These are baskets of securities that seek to mirror the performance of a specific broad market index, such as the S&P 500, the S&P/TSX Composite, or the NASDAQ 100.

This approach differs from actively managed mutual funds, where the fund manager attempts to outperform an underlying benchmark by regularly buying and selling investments.

SmartFolio’s passive investments can be advantageous due to their lower costs, which help investors keep more of their returns.

BMO SmartFolio available account types

BMO SmartFolio offers the following account types:

- Non-registered (single and joint)

- Registered Retirement Savings Plan (RRSP)

- Tax-Free Savings Account (TFSA)

- Registered Education Savings Plan (RESP)

- Registered Retirement Income Fund (RRIF)

- Spousal RRSPs and RRIFs

Unfortunately, a few account types are not yet supported, including First Home Savings Accounts (FHSAs), Locked-In Retirement Accounts (LIRAs) and Life Income Funds (LIFs).

BMO Smartfolio asset availability

As with most robo-advisors, BMO Smartfolio portfolios only invest in ETFs. You cannot hold mutual funds, individual stocks or bonds. But that’s not a bad thing, as ETFs offer instant diversification, with access to equities and bonds at a low cost.

How BMO SmartFolio compares

BMO SmartFolio vs. Wealthsimple Invest

Wealthsimple Invest is a leading Canadian robo-advisor. It offers lower fees than SmartFolio, with annual pricing starting at 0.50% and dropping to 0.40% at $100,000, and its underlying ETFs have lower MERs, on average. It also offers socially responsible investing (SRI) and halal portfolios, which SmartFolio does not. That said, it only provides three principal portfolios (Conservative, Balanced and Growth), compared to five from BMO Smartfolio. This makes it more challenging to finetune your asset allocation.

If fees are your primary consideration, Wealthsimple Invest is your best bet. If you are an existing BMO client or want more precision in your portfolio mix, SmartFolio may be the way to go.

Wealthsimple managed investing

BMO SmartFolio vs. RBC InvestEase

RBC InvestEase is a robo-advisor platform from Canada’s largest bank and the only big-bank robo-advisor besides BMO SmartFolio. It offers a few key advantages over SmartFolio, including lower management fees for portfolios up to $500,000, lower ETF MERs, access to SRI portfolios and an FHSA account option. It does not offer an RESP account and uses iShares ETFs in its portfolios instead of its own ETFs.

Which one should you choose? If you’re an RBC client, stick with InvestEase. If you’re a BMO client, you’ll likely be happy with SmartFolio. If you want the lowest fees, avoid the big banks altogether and invest with Wealthsimple, Questwealth Portfolios or Justwealth.

BMO SmartFolio vs. BMO AdviceDirect

BMO AdviceDirect is a unique investing platform that offers self-directed investing with the ability to access dedicated advisor support. Investors can buy and sell individual stocks and ETFs and get advice from a professional advisor when needed. Think of it as a blend of personalized financial planning and DIY investing. While it offers more flexibility and control than BMO SmartFolio, it’s also more expensive. The annual management fee is 0.75% for assets up to $500,000, and you must have a minimum of $10,000 to invest.

If you prefer hands-off investing, BMO SmartFolio is the way to go. If you want to be more involved with the day-to-day investment decisions while benefiting from personalized advice, consider BMO AdviceDirect.

BMO Smartfolio vs. BMO InvestorLine

BMO InvestorLine is an entirely self-directed investing platform. It’s ideal for BMO clients who want complete control over their investments, don’t mind doing their own research, or require financial planning or advisor services.

InvestorLine does not charge any management fees, but you will pay a $9.95 commission to trade stocks and ETFs (there are some commission-free ETFs available). Choose SmartFolio if you want to follow a passive investing strategy. If you want to trade stocks, ETFs or other investments, consider BMO InvestorLine.

How to open and fund a BMO SmartFolio account

You can open a BMO SmartFolio account online. The process takes approximately 15 minutes, but you can save your progress and come back to complete the application later if needed.

- Come prepared with your Social Insurance Number (SIN), employment status and work address (if applicable) and bank account information. You’ll need to deposit at least $1,000 to open an account.

- Select a primary financial goal and an account type (TFSA, RRSP, etc.).

- Complete a risk assessment questionnaire to determine your recommended model portfolio.

- Fund your account via a bank transfer. You can also arrange for regular pre-authorized contributions.

Customer support and investor resources

SmartFolio customer support is available via phone, online contact form and live chat. You can speak to a BMO SmartFolio Advisor by calling 1-844-895-3721, Monday to Friday, 8 AM to 6 PM ET. Live chat is available from 8 AM to 8 PM ET.

BMO also offers an Investment Learning Centre on its website. Investors can access articles, video courses and podcasts covering various investing topics, as well as webinars, financial calculators and insights from BMO investment professionals.

Final verdict: Is BMO SmartFolio worth It?

BMO is well-suited for BMO customers and hands-off investors looking for a robo-advisor platform with transparent, if not best-in-class, pricing and straightforward model portfolios. Unfortunately, it’s more expensive than other robo-advisors, not only in terms of management fees but also due to ETF MERs, which are higher than many competitors. And while it won’t matter to everyone, ETF choices are limited to BMO funds.

Ultimately, SmartFolio is a solid choice for BMO customers who will appreciate the convenience of dealing with one institution. Otherwise, look closely at top platforms like Wealthsimple or JustWealth before you make a final decision.

Colin Graves is a Winnipeg-based financial writer and editor whose work has been featured in publications such as Time, MoneySense, MapleMoney, Retire Happy, The College Investor, and more. Before becoming a full-time writer, Colin was a bank manager for over 15 years.

More robo advisor content

More robo advisor content

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.