Tired of losing money on currency conversion fees when investing in US stocks from Canada?

Norbert’s Gambit is a clever, low-cost strategy that lets you exchange CDN to USD (and vice versa) while avoiding hefty bank spreads. Whether you're a seasoned investor or just getting started, this guide will walk you through everything you need to know to save big on forex fees.

What is Norbert's gambit?

Norbert’s Gambit is a simple yet powerful currency conversion strategy that lets Canadians exchange CDN to USD (and vice versa) at a fraction of the cost of traditional methods.

By using interlisted stocks — specifically the Horizons US Dollar Currency ETF (DLR.TO1 in CDN and DLR.U.TO2 in USD) — investors can sidestep hefty forex fees charged by banks and brokerages.

How it works and why it’s so cheap

Normally, when you convert currency through your bank or brokerage, you get hit with a 1.5% to 2.5% currency spread — a hidden fee that quickly adds up. With Norbert’s Gambit, you avoid this markup by:

- 1 Buying DLR.TO (CDN version) on the TSX

- 2 Journaling those shares to DLR.U.TO (USD version) within your brokerage

- 3 Selling DLR.U.TO for USD cash

This method works because DLR.TO and DLR.U.TO represent the same ETF — just in different currencies. By converting your money this way, you’re effectively exchanging at the true market rate, saving hundreds (or even thousands) in the process.

Who benefits from Norbert’s Gambit?

- Investors buying US stocks in RRSPs to avoid US withholding tax3

- Cross-border shoppers who need USD for frequent purchases

- Canadians with US expenses (vacation homes, tuition, etc.)

Quick tip: You’ll need a brokerage that supports journaling shares — Questrade is the top choice here.

Real savings: Norbert’s Gambit vs. traditional conversion

Let’s say you need to convert $10,000 CDN to USD:

The difference? You keep more of your money instead of handing it over in fees.

That’s the power of Norbert’s Gambit — simple, effective and nearly free.

When should you use Norbert’s Gambit?

Norbert’s Gambit is a fantastic tool for saving on currency exchange fees, but it’s not always the best choice. Here’s when it works well and when you might want to consider alternatives:

- Converting $1,000+ CDN to USD: The savings increase with larger amounts, making it worthwhile.

- Investors buying US stocks or ETFs in a TFSA or RRSP: Helps avoid US withholding taxes on dividends.

- People who don’t need funds immediately: The process takes three to four business days to complete.

- You need instant conversion: Norbert’s Gambit takes time, while traditional exchanges are immediate.

- You’re uncomfortable with minor currency fluctuations: The exchange rate may shift slightly while waiting for the shares to journal.

Update (April 2025):

If you’re dealing with larger sums and can wait a few days, Norbert’s Gambit is the best way to maximize your exchange rate and keep more of your money.

- Questrade now charges a $9.95 CDN journaling fee.

- Despite this fee, Norbert’s Gambit still offers significant savings, as traditional conversion fees can be 10 times more expensive in some cases.

- While Questrade now charges a $9.95 CDN journaling fee, some brokerages — like RBC Direct Investing — offer journaling at no cost.

How to do Norbert’s Gambit (step-by-step guide)

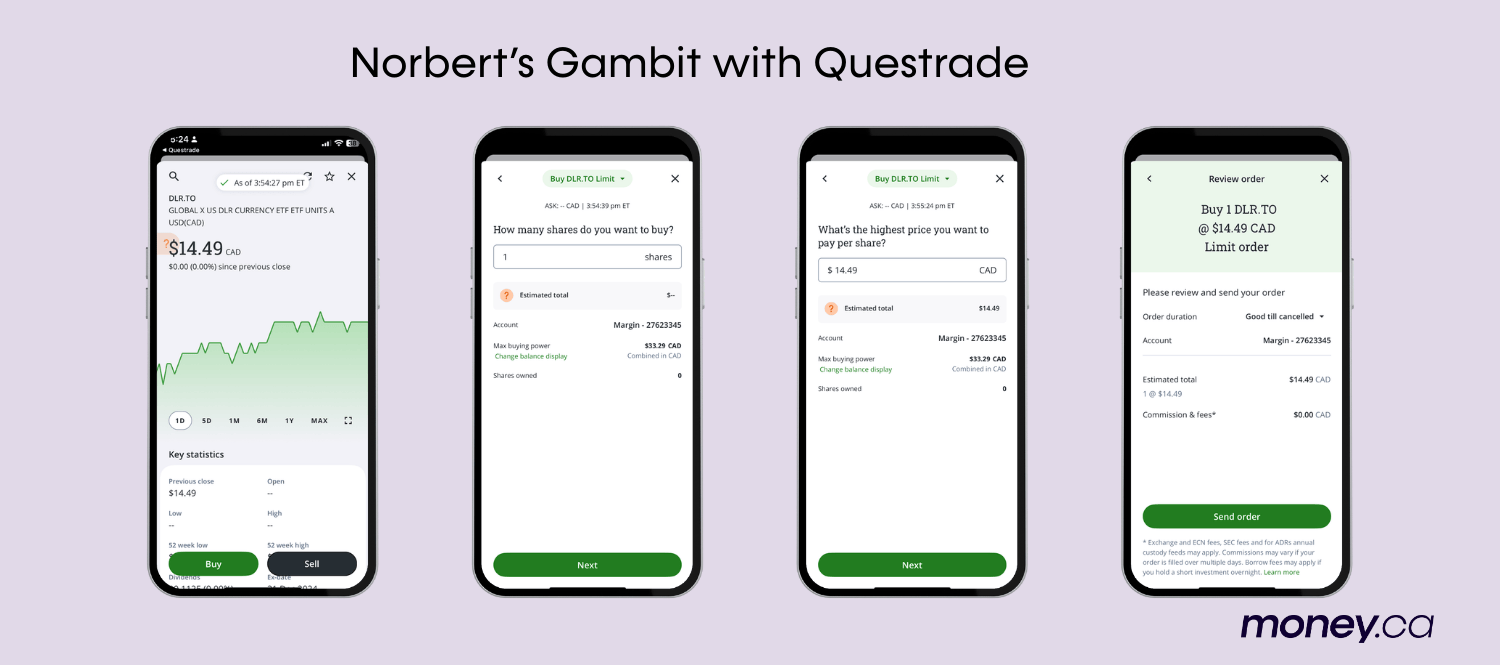

Step 1: Buy DLR.TO in CDNLog into your brokerage account and purchase DLR.TO (Horizons US Dollar Currency ETF) using Canadian dollars (CDN). Ensure you use a limit order to avoid price fluctuations.

Step 2: Request to Journal Shares to DLR.U.TO. Once the trade settles (usually two days), request your brokerage to journal your DLR.TO shares into DLR.U.TO, the USD equivalent. Some brokers require a manual request, while others offer automated journaling.

Step 3: Wait three to four business days for processing

Once journaling is complete, sell your DLR.U.TO shares in your brokerage account. This effectively converts your CDN to USD at the true market exchange rate with minimal fees.

Step 4: Sell DLR.U.TO for USD

Once journaling is complete, sell your DLR.U.TO shares in your brokerage account. This effectively converts your CDN to USD at the true market exchange rate with minimal fees.

Step 5: Withdraw USD or reinvest in US securities

After settlement, the USD cash will be available in your account. You can now withdraw it to a US bank account or use it to buy US stocks, ETFs or other securities while avoiding unnecessary conversion fees.

Pro tip: Always use limit orders instead of market orders to avoid unexpected price fluctuations.

Best platforms for Norbert’s Gambit in Canada

- Low trading fees: Questrade offers commission-free ETF trading, including DLR.TO and DLR.U.TO, and does not charge ECN fees (as of February 2025).

- Supports CDN and USD accounts: Avoids forced conversions that can cost you money.

- Reliable journaling process: Simple request via online chat or secure message.

- No support for traditional Norbert’s Gambit: Wealthsimple does not allow journaling between CDN and USD stocks.

- Wealthsimple USD Account: Allows cross-border transactions without manual conversions.

- Better for beginners: Ideal for those who prefer instant USD conversion instead of waiting three to four days.

- Journaling is manual: Unlike Questrade, TD requires you to request journaling via phone or secure message.

- Processing time is two to four business days: Similar to most brokerages, expect a short wait before your shares convert.

- No journaling fee: TD Direct Investing does not charge a fee for journaling, but standard trading commissions apply.

- Best for larger conversions: Norbert’s Gambit is most cost-effective when converting $1,000+, making TD a good option for bigger transactions.

Step 1: Buy DLR.TO (CDN version) in your TD Direct Investing account

- You can do this in a TFSA, RRSP or non-registered account.

- Use a limit order to control your purchase price and avoid unexpected fluctuations.

Step 2: Request to journal shares from CDN to USD

- Unlike Questrade, TD Direct Investing requires you to call in or submit a request through their Secure Message Centre.

- No online journaling tool is available, so manual intervention is necessary.

Step 3: Wait for processing (two to four business days)

- The journaling process usually takes two to four business days before your shares convert to DLR.U.TO (USD version).

Step 4: Sell DLR.U.TO shares in USD

- Once the journaling is complete, sell your DLR.U.TO shares to receive USD in your TD account.

Step 5: Withdraw or reinvest in USD securities

- Your USD balance is now available for withdrawing to a US bank account or reinvesting in US stocks or ETFs.

Summary: Comparing three platforms

Remember: Wealthsimple does not support traditional Norbert’s Gambit as it does not allow journaling between CDN and USD stocks. However, it offers a USD account for cross-border transactions without conversion fees.

Costs and fees: Is Norbert’s Gambit worth it?

For most investors, the answer is yes — as long as you're converting at least $1,000 CDN. Here’s why:

Traditional currency conversion fees

- Banks and brokerages typically charge 1.5% or more per transaction.

- That means for every $10,000 CDN converted, you could be paying $150+ in hidden fees.

Norbert’s Gambit costs

- Brokerage fees: $10 to $15 total, depending on your broker.

- Even with Questrade’s new $9.95 journaling fee (as of April 2025), it’s still much cheaper than a bank conversion.

Break-even point: When does Norbert’s Gambit make sense?

- If you’re converting $1,000+, the savings make it worth using.

- Anything under $1,000? The time and effort may not justify the small savings.

Comparing Brokers: Questrade vs. Wealthsimple vs. RBC Direct

- Questrade: Best for easy, low-cost journaling ($9.95 fee but zero commissions on stocks/ETFs).

- Wealthsimple: No support for traditional Norbert’s Gambit, but offers a USD account for easy conversions.

- RBC Direct Investing: No journaling fees, but manual processing is required.

Converting $10,000 CDN to USD

Should you buy USD stocks in TFSA or RRSP?

Where you hold US stocks matters more than you think — especially when it comes to taxes and fees. Here’s what you need to know:

TFSA vs. RRSP for US Stocks and ETFs

- RRSP: The best place for the US-listed ETFs. Thanks to the Canada-US tax treaty, you don’t pay the 15% withholding tax on dividends here.

- TFSA: Not ideal for US stocks. You still avoid capital gains taxes, but you’ll lose 15% of dividends to US withholding tax, and there’s no way to get it back.

Currency conversion considerations

- US-listed ETFs trade in USD, so if you’re buying them in a Canadian account, you’ll need to convert CDN to USD first.

- If you go this route, Norbert’s Gambit is the cheapest way to handle the conversion without getting ripped off by your broker’s FX fees.

Key takeaways

- Dividend-paying US stocks? Use an RRSP. That’s where you’ll avoid the 15% tax hit.

- Just looking for capital gains? If you invest in US stocks primarily for capital gains, a TFSA works great. But if you want to hold US dividend-paying stocks, a Canadian-listed ETF tracking the US market (like VFV) avoids the 15% withholding tax

- Don’t want to deal with FX fees? Canadian-listed ETFs tracking US markets (like VFV instead of VOO) let you invest in US stocks without touching USD.

Want the full breakdown? Canadian ETFs vs US ETFs

Common mistakes and how to avoid them

- Buying DLR.TO at market price: Always use a limit order instead. Market orders can get filled at unexpected prices, costing you more than necessary.

- Forgetting to set “currency of transaction” on Questrade: If you don’t adjust this setting, Questrade will auto-convert your USD back to CDN, wiping out your savings.

- Not accounting for the time delay: This isn’t an instant process. Expect three to four business days for the entire conversion to go through, so plan ahead.

- Converting small amounts: If you're exchanging less than $1,000, the savings aren’t really worth the effort. Stick to larger amounts to make Norbert’s Gambit pay off.

FAQs

Noel Moffatt is a Canadian fintech expert with a passion for simplifying personal finance. Based in St. John’s, NL, he draws on his background in finance, SEO, and writing to deliver clear explanations and actionable advice. Noel is dedicated to equipping readers with the knowledge and tools they need to make informed financial decisions, striving to make personal finance more accessible and understandable through his in-depth articles and reviews.

Explore the latest articles

How a man travelled the world in 24-hour trips

Kevin Droniak went viral for taking whirlwind international trips without booking hotels. Here's what Canadians can learn from his budget travel hacks — and how to stretch your dollar further for your next getaway

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.