-1745505749.png)

Where can I use my American Express credit card in Canada?

American Express credit cards are consistently rated as some of the best credit cards in Canada. Still, despite this stellar reputation, these credit cards also have an unfair reputation of not being widely accepted across the country, which causes many Canadians to avoid them. So, where is American Express accepted in Canada?

American Express has recently expanded its acceptance rate, and since, most major retailers accept American Express credit cards, including those listed below:

At a glance

| Category | Example brands |

|---|---|

| Clothing | Aldo, Ardenne, H&M, Hudson’s Bar, Marshalls, Mark’s, Sport Chek, Sunglass Hut, Winner |

| Department stores (including online) | Canadian Tire, Amazon, Walmart |

| Dining | McDonald’s, Starbucks, Burger King, Oliver & Bonacini, Tim Hortons |

| Electronics | Apple, Best Buy, Canada Computers, Staples |

| Gas (including fuel) | Esso, Petro-Can, Shell, Ultramar, Irving Oil, Fast Gas Plus, Co-Op Gas Bars, Race Trac, Bluewave Energy |

| Groceries | Safeway, Sobeys, Metro, Metro Plus, Longos, Whole Foods Market, 7-Eleven, Circle K, Super C, Marché Richelieu, IGA, FreshCo |

| Hardware stores | The Home Depot |

| Home goods (including furnishings and décor) | Homesense, Hudson’s Bay, IKEA, Lowe’s, Marshall’s |

| Hotels | Fairmont Resorts & Hotels, Marriott, Hilton, IHG, Holiday Inn, Best Western, Radisson, Sheraton |

| Pharmacies (including drugstores) | London Drugs, Jean Coutu, Rexall, Uniprix, Uniprix Sante, Uniprix Clinique |

Major chains:

- Sobeys

- Metro and Metro Plus

- Safeway

- Whole Foods Market

- IGA

- Adonis Market

- Super C

- FreshCo

- Save-On-Foods

- Farm Boy

- Food Basics

- Walmart Supercenters

Convenience stores and specialty grocers:

- Première Moisson

- Marché Richelieu

- Longo's

- Pusateri's

- Rabba

- 7-Eleven

- Couche-Tard

- Circle K

- Federated Co-op

Our top Amex pick for groceries

The Cobalt Card offers an impressive 5x points (5% return) on groceries at most major Canadian supermarkets that accept Amex. This is the highest earn rate on groceries available from any premium credit card in Canada.

- Spending example: If you spend $800 monthly on groceries

- Earnings: 4,000 MR points monthly = 48,000 points annually

- Value: $480-$960 per year (1-2 cents per point)

- Shell Canada

- Petro-Canada

- Esso

- Ultramar

- Irving Oil

- Pioneer Energy

- Fas Gas

- Ultramar

- Irving Oil

- Race Trac

Our top Amex pick for gas stations

The American Express Cobalt® Card is without question Amex Canada’s premier option for rewards when it comes to gas and groceries. earns 2x points on eligible gas, transit and ride shares in Canada, effectively a 2% return.

- Spending example: If you spend $300 monthly on gas

- Earnings: 600 MR points monthly = 7,200 points annually

- Value: $72-$144 per year (1-2 cents per point, depending on redemption)

- Jean Coutu

- Uniprix, Uniprix Santé and Uniprix Clinique

- Familiprix

- Shoppers Drug Mart

- London Drugs

- Rexall

Our top Amex pick for drugstores

The American Express SimplyCash Preferred™ Card earns a base rate of 2% on all non-bonus purchases, which includes drugstores. This makes the SimplyCash Preferred a great set-it-and-forget-it option no matter where you shop.

- Spending example: If you spend $200 monthly at drugstores

- Earnings: $4 cash back monthly = $48 annually

- Value: $48 per year (straightforward cash value)

Fast food:

- McDonald's

- Burger King

- Starbucks

- Subway

- Thai Express

- Thai Zone

- Tim Hortons

- Wendy's

Restaurants:

- Swiss Chalet

- St-Hubert

- La Cage

- Barbie's Resto Bar Grill

- Les 3 Brasseurs

- Restaurant Normandin

- Poulet Rouge

- Rotisserie Fusée

- Le Coq Rôti

- Mikes

- Cora

- Ben Florentine

- Petino's

- Eggspectation

- La Belle Province

- Pizza Salvatoré

- Chez Ashton

- Queues de Castor/Beavertails

- CopperBranch

- Yuzu Sushi

Food delivery services:

- Uber Eats

- SkipTheDishes

- Cook It

- Hello Fresh

- GoodFood

- TooGoodToGo

- FoodHero

- FlashFood

Our top Amex pick for dining

For restaurant and food delivery spending, the Cobalt Card is unmatched with its 5x points on restaurants, cafés, bars, and food delivery services. This translates to a 5% return when redeemed for travel through the Amex Fixed Points Travel Program or for statement credits.

- Spending example: If you spend $400 monthly on restaurants and food delivery

- Earnings: 2,000 MR points monthly = 24,000 points annually

- Value: $240-$480 per year

Department stores:

- Hudson's Bay

- Walmart

- Winners

- Marshalls

- HomeSense

- Amazon.ca

Clothing:

- H&M

- Aldo

- Michael Kors

- Uniqlo

- Ardène

- Globo

- Sunglass Hut

Electronics and office supplies:

- Apple Store

- Google Store

- Staples

- GameStop

- Canada Computers

- Best Buy

Home goods and furnishings:

- IKEA

- Wayfair

- Dollarama

- DeSerres

- Michaels

Home improvement:

- Canadian Tire

- Home Depot

- Lowe's

- Rona

- Réno-Dépôt

- Canac

- Patrick Morin

- Home Hardware

Other retailers:

- Apple Music, Apple TV+

- Sports aux Puces

- SAQ

- LCBO

- Beer Store

Our top Amex pick for retail and online shopping

The SimplyCash Preferred Card offers a straightforward 2% cash back on all purchases with no category restrictions, making it ideal for online shopping where specialty category bonuses might not apply.

- Spending example: If you spend $500 monthly on various online purchases

- Earnings: $10 cash back monthly = $120 annually

- Value: $120 per year (straightforward cash value)

Airlines:

- Air Canada

- Frontier Airlines

- WestJet

- Air Transat

Hotels:

- Marriot

- Hilton

- Starwood Hotels

- Fairmont Resorts

- IHG

- Holiday Inn

- Best Western

- Radisson Hotels

- Sheraton

Car rentals:

- Budget

- Avis

Other:

- Flight Centre

Our top Amex travel pick

For frequent travellers, we recommend the Platinum Card despite its $799 annual fee. It offers comprehensive travel benefits including airport lounge access with Priority Pass and Centurion Lounges, hotel status upgrades with Marriott Bonvoy and Hilton Honors, and an annual $200 travel credit.

- Spending example: If you spend $5,000 annually on flights and hotels

- Earnings: 10,000 MR points from travel + perks valued at $1,000+ (lounge access, hotel upgrades)

- Value: $100-$200 from points + $1,000+ in benefits

- Canada Post

- Circuit Électrique (charging stations)

- Laboratoire Biron

- Imagix

- Medvue

Our top Amex pick for services and other spending

The Scotiabank Gold Amex provides a base earn rate of 1 Scene+ point per dollar on all "other" purchases that don't fall into bonus categories, including utilities, insurance payments, subscriptions, and miscellaneous services. While this 1% return isn't spectacular on its own, the card's overall earning structure makes it valuable

- Spending example: If you spend $300 monthly on services like utilities, insurance, and subscriptions

- Earnings: 300 Scene+ points monthly = 3,600 points annually

- Value: $36 per year (Scene+ points valued at approximately 1¢ per point)

The lists above are just a small sampling of the thousands of retailers in Canada that accept American Express credit cards.

Where is Amex not accepted in Canada?

While many Canadian retailers accept Amex cards, not all do. There are a few major retailers in Canada that don’t accept American Express credit cards. Some retailers don’t accept American Express because they have their own branded credit cards they’d prefer you to use. In addition, due to the higher fee Amex charges its retail partners (rather than Visa or Mastercard), many opt out of accepting an American Express credit card.

So, which brands won't let you pay with an Amex credit card? As of 2025, a few major brands don't accept American Express:

Costco Canada doesn't accept American Express cards because of an exclusive partnership agreement with Mastercard - it's that simple.

Prior to 2015, Costco Canada actually had an exclusive relationship with American Express for about 15 years. However, this partnership ended in December 2014 when they couldn't reach "commercially acceptable terms" during contract renewal negotiations.

Looking to maximize your rewards and save money at Costco? Check out the CIBC Costco Mastercard®:

$336

First Year Value

$0

Annual Value

Get this card if you...

-

are a Costco member, wanting to earn cash back on purchases

-

want to avoid paying an annual fee

-

want perks like purchase protection and mobile device insurance

Annual Fee & Annual Interest Rates

$0

Annual Fee

20.75%

Purchase

22.49%

Cash Advance

22.49%

Balance Transfer

Our Take

The CIBC Costco Mastercard® is a no-annual-fee credit card tailored for Costco members, offering cash back on various purchase categories, including elevated rates for dining and gas purchases at Costco gas stations. Cardholders benefit from features such as mobile device insurance and the convenience of combining their credit card with their Costco membership card to maximize their cash back.

Eligibility

Good (620 - 670)

Recommended Credit Score

$15,000

Required Annual Personal Income

Pros

-

No annual fee

-

No fee for additional cards

-

Earn up to 3% cash back

-

Can double as your Costco membership card (though you’ll still have to pay the Costco membership fee)

-

Mobile device insurance

Cons

-

Exclusive to Costco members

-

Low cash back rate of 1% for purchases at Costco

-

High interest rate of 20.75%

-

Cash back can only be redeemed at Costco

Annual Interest Rates

20.75%

Purchase

22.49%

Cash Advance

22.49%

Balance Transfer

25.99%

Penalty

Fees

$0

Annual Fee

2.50%

Foreign Transaction

5.00%

Balance Transfer

$5

Cash Advance

$29

Over The Limit Penalty

$42.5

Return Penalty

Rewards cash back

3%

cash back at restaurants and at Costco gas

2%

cash back at other eligible gas stations, electric vehicle charging stations and at Costco.ca

1%

cash back on all other purchases including at Costco

Insurance Benefits

$1,000

Mobile device insurance amount

Our Take

The CIBC Costco Mastercard® is a no-annual-fee credit card tailored for Costco members, offering cash back on various purchase categories, including elevated rates for dining and gas purchases at Costco gas stations. Cardholders benefit from features such as mobile device insurance and the convenience of combining their credit card with their Costco membership card to maximize their cash back.

Eligibility

Good (620 - 670)

Recommended Credit Score

$15,000

Required Annual Personal Income

Pros

-

No annual fee

-

No fee for additional cards

-

Earn up to 3% cash back

-

Can double as your Costco membership card (though you’ll still have to pay the Costco membership fee)

-

Mobile device insurance

Cons

-

Exclusive to Costco members

-

Low cash back rate of 1% for purchases at Costco

-

High interest rate of 20.75%

-

Cash back can only be redeemed at Costco

Annual Interest Rates

20.75%

Purchase

22.49%

Cash Advance

22.49%

Balance Transfer

25.99%

Penalty

Fees

$0

Annual Fee

2.50%

Foreign Transaction

5.00%

Balance Transfer

$5

Cash Advance

$29

Over The Limit Penalty

$42.5

Return Penalty

Rewards cash back

3%

cash back at restaurants and at Costco gas

2%

cash back at other eligible gas stations, electric vehicle charging stations and at Costco.ca

1%

cash back on all other purchases including at Costco

Insurance Benefits

$1,000

Mobile device insurance amount

Disclosures:

- †Terms and Conditions Apply. This offer is not available for residents of Quebec.

-

Any opinions, analyses, reviews, or recommendations expressed on this page are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by our advertising partners.

Read more: Best Costco Credit Cards in Canada

Like Costco, Loblaws banner brands also do not accept American Express credit cards in Canada. Instead of Amex, Loblaws only accepts Visa and Mastercard credit cards in Canada. This is likely as a result of the higher merchant fees American Express charges versus other card issuers.

This limitation applies to all Loblaws-owned stores, including:

- Real Canadian Superstore

- No Frills

- Shoppers Drug Mart

- Zehrs

- Fortinos

- Provigo

- Maxi

- And other Loblaws banner stores

Looking to maximize your rewards and save money at Loblaws banner brands? Check out PC Financial and its popular PC Mastercard line-up:

PC Insiders™ World Elite® Mastercard®

Get up to 100,000 bonus PC Optimum™ points†.

$120 Annual Fee

Very Good Recommended Credit Score

$80,000 Required Annual Personal Income

PC® World Elite Mastercard®

Get up to 100,000 bonus PC Optimum™ points†.

$0 Annual Fee

Fair Recommended Credit Score

$80,000 Required Annual Personal Income

PC® Mastercard®

Get up to 100,000 bonus PC Optimum™ points†.

$0 Annual Fee

Good Recommended Credit Score

$15,000 Required Annual Personal Income

Disclosures:

-

Sponsored advertising. President’s Choice Financial® Mastercard® is provided by President’s Choice Bank. The PC Optimum™ program is provided by President's Choice Services Inc. President’s Choice Bank is not responsible for the contents of this site, including any editorials or reviews that may appear on this site. For complete information regarding the PC® Mastercard®, PC® World Mastercard®, or PC® World Elite Mastercard®, please click on the “Apply Now” or other applicable button.

Read more: Best PC financial credit cards in Canada

You'll also struggle to use your Canadian Amex credit card at Save-On-Foods, the western supermarket chain, which, like Costco, only accepts either Visa or Mastercard. Additionally, smaller businesses (and especially those in rural areas outside major cities like Edmonton and Calgary). Other than these retailers, you should be able to use your American Express credit card everywhere you shop.

What should I do if my Amex wasn’t accepted?

If you do run into a situation where you can’t use your American Express credit card, it’s a good idea to have a backup credit card in your wallet. If you’re an avid Costco shopper, a backup Mastercard may be a good idea to maximize your rewards earning at that major retailer.

No matter what the situation, if you find yourself in a position where you can’t use your credit card, American Express wants to know. They’ve created an easy-to-use feedback form to help determine where American Express credit cards are not accepted.

Why get an American Express credit card?

American Express cards offer rewards that make Visa and Mastercard look like toys. The Cobalt Card gives you 5x points on food and drink – that’s effectively 5-10% back depending on how you redeem.

Book travel with your Platinum Card and get better coverage than most paid insurance plans. We’re talking:

- $5 million in emergency medical coverage

- Trip cancellation/interruption protection

- Flight delay insurance that kicks in after just 4 hours

- Rental car coverage so good you can laugh at the rental counter upsell

Lounge access that really works. Hotel upgrades that actually happen. Concierge service that doesn’t suck. Amex delivers premium perks that other cards merely promise.

If you travel frequently, some American Express credit cards offer great benefits at airports across the country. These benefits could include free airport lounge access, valet services, priority security line access to skip those long security lines, and priority check-in.

Start earning with our top Amex card picks for Canadians

Top Amex credit cards to consider

up to 15,000 points

Welcome Bonus

$630

First Year Value

$480

Annual Value

Welcome Bonus: Earn up to 15,000 Welcome Bonus Membership Rewards® points* – that’s up to $150 in value.

Get this card if you...

-

quickly rack up rewards on dining and grocery purchases

-

want a flexible rewards program with travel rewards

-

want access to exclusive events and robust travel insurance

Annual Fee & Annual Interest Rates

$155.88

Annual Fee

21.99%

Purchase

21.99%

Cash Advance

Our Take

The American Express Cobalt® Card is a versatile rewards credit card designed for individuals who frequently spend on dining, groceries and travel-related expenses. It offers flexible redemption options and includes various travel and purchase protections, making it a comprehensive choice for those seeking to maximize rewards on everyday spending.

Eligibility

Fair (300 - 619)

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Pros

-

High earn rates (up to 5% return on spending!)

-

Flexible month-by-month fee structure

-

Free supplementary cards

-

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Cons

-

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

-

Amex has a more limited merchant acceptance rate than Visa and Mastercard

-

Slightly higher than average annual fee

Annual Interest Rates

21.99%

Purchase

21.99%

Cash Advance

28.99%

Penalty

Fees

$155.88

Annual Fee

2.50%

Foreign Transaction

$2.75

Cash Advance

$29

Over The Limit Penalty

$45

Return Penalty

Rewards Membership Rewards

5x

the points on eligible eats & drinks purchases in Canada

3x

the points on eligible streaming subscriptions in Canada

2x

the points on eligible gas, transit & ride share in Canada

1x

the points on everything else

1

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

$100 USD

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

Insurance Benefits

$1,000

Mobile device insurance amount

$5,000,000

Emergency medical insurance amount

$250,000

Travel accident insurance amount

$500

Hotel burglary insurance

$85,000

Rental car insurance amount

Earn up to 15,000 Membership Rewards® points* by earning 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 on your Card in your first year as a new Cardmember. This could add up to 15,000 points in a year.*

That’s up to $150 towards your next weekend getaway.

*Current or former Cardmembers with this Card are not eligible for this offer. Other terms apply.

Our Take

The American Express Cobalt® Card is a versatile rewards credit card designed for individuals who frequently spend on dining, groceries and travel-related expenses. It offers flexible redemption options and includes various travel and purchase protections, making it a comprehensive choice for those seeking to maximize rewards on everyday spending.

Eligibility

Fair (300 - 619)

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Pros

-

High earn rates (up to 5% return on spending!)

-

Flexible month-by-month fee structure

-

Free supplementary cards

-

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Cons

-

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

-

Amex has a more limited merchant acceptance rate than Visa and Mastercard

-

Slightly higher than average annual fee

Annual Interest Rates

21.99%

Purchase

21.99%

Cash Advance

28.99%

Penalty

Fees

$155.88

Annual Fee

2.50%

Foreign Transaction

$2.75

Cash Advance

$29

Over The Limit Penalty

$45

Return Penalty

Rewards Membership Rewards

5x

the points on eligible eats & drinks purchases in Canada

3x

the points on eligible streaming subscriptions in Canada

2x

the points on eligible gas, transit & ride share in Canada

1x

the points on everything else

1

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

$100 USD

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

Insurance Benefits

$1,000

Mobile device insurance amount

$5,000,000

Emergency medical insurance amount

$250,000

Travel accident insurance amount

$500

Hotel burglary insurance

$85,000

Rental car insurance amount

Earn up to 15,000 Membership Rewards® points* by earning 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 on your Card in your first year as a new Cardmember. This could add up to 15,000 points in a year.*

That’s up to $150 towards your next weekend getaway.

*Current or former Cardmembers with this Card are not eligible for this offer. Other terms apply.

The Cobalt Card is Money.ca's best credit card thanks to its generous up to 5x points on eligible dining and groceries in Canada, bonus earn rates on streaming, gas, transit and rideshare purchases and up to 15,000 Membership Rewards® points* welcome bonus. Even better, the $155.88 annual fee is billed at $$12.99/month, which can help make the card more affordable by using Amex MR points to pay that monthly fee.

Disclosures

-

Contact American Express for the most up-to-date referral bonus figures.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

up to 100,000 points

Welcome Bonus

$471

First Year Value

$0

Annual Value

Welcome Bonus: Earn up to 100,000 Membership Rewards® points* – that’s up to $1,000 in value.

Get this card if you...

-

are a frequent traveler who wants luxury perks like lounge access

-

want to rack up rewards quickly

-

want great travel insurance, perks and concierge services

Annual Fee & Annual Interest Rates

$799

Annual Fee

21.99% - 28.99%

Purchase

Our Take

The American Express Platinum Card® is a premium travel rewards credit card offering elevated Membership Rewards® points on eligible purchases, with a substantial welcome bonus for new cardholders. Cardholders enjoy exclusive benefits such as access to over 1,300 airport lounges worldwide through the American Express Global Lounge Collection™, comprehensive travel insurance, and personalized concierge services.

Eligibility

Excellent (740+)

Recommended Credit Score

Pros

-

Access to a wide range of luxury perks, including premium concierge service

-

Complimentary lounge membership providing access to over 1,400+ airport lounges worldwide

-

Annual statement credits: $200 annual travel credit, $200 annual dining credit

-

Special insurance coverages like trip cancellation/interruption, flight delay, lost or stolen baggage and rental car theft & damage.

-

Provides extended warranty (2 years) and purchase protection (120 days).

Cons

-

High annual fee of $799, one of the heftiest among Canadian cards

-

The rewards system can be complicated, especially for users not familiar with maximizing credit card points

-

Requires good to excellent credit for eligibility

Annual Interest Rates

21.99% - 28.99%

Purchase

30.00%

Penalty

Fees

$799

Annual Fee

2.50%

Foreign Transaction

$45

Return Penalty

Rewards Membership Rewards

2x

points for every $1 in Card purchases on eligible dining and food delivery in Canada

2x

points for every $1 in Card purchases on eligible travel

1x

point for every $1 in all other Card purchases

1

additional point on Amex Travel Online for eligible hotel or car rental bookings

Insurance Benefits

$5,000,000

Emergency medical insurance amount

$500,000

Travel accident insurance amount

$1,000

Hotel burglary insurance

$85,000

Rental car insurance amount

Earn up to 100,000 Membership Rewards® points* – that’s up to $1,000 in value.

Earn 70,000 Membership Rewards® points after spending $10,000 on your Card within your first 3 months as a new Platinum® Cardmember. That’s $700 towards your next flight.

Plus, earn 30,000 points* when you make a purchase between 14 and 17 months of Cardmembership.* That’s $300 towards dinner out with friends.

*Current or former Cardmembers with this Card are not eligible for these offers. Other terms apply.

Our Take

The American Express Platinum Card® is a premium travel rewards credit card offering elevated Membership Rewards® points on eligible purchases, with a substantial welcome bonus for new cardholders. Cardholders enjoy exclusive benefits such as access to over 1,300 airport lounges worldwide through the American Express Global Lounge Collection™, comprehensive travel insurance, and personalized concierge services.

Eligibility

Excellent (740+)

Recommended Credit Score

Pros

-

Access to a wide range of luxury perks, including premium concierge service

-

Complimentary lounge membership providing access to over 1,400+ airport lounges worldwide

-

Annual statement credits: $200 annual travel credit, $200 annual dining credit

-

Special insurance coverages like trip cancellation/interruption, flight delay, lost or stolen baggage and rental car theft & damage.

-

Provides extended warranty (2 years) and purchase protection (120 days).

Cons

-

High annual fee of $799, one of the heftiest among Canadian cards

-

The rewards system can be complicated, especially for users not familiar with maximizing credit card points

-

Requires good to excellent credit for eligibility

Annual Interest Rates

21.99% - 28.99%

Purchase

30.00%

Penalty

Fees

$799

Annual Fee

2.50%

Foreign Transaction

$45

Return Penalty

Rewards Membership Rewards

2x

points for every $1 in Card purchases on eligible dining and food delivery in Canada

2x

points for every $1 in Card purchases on eligible travel

1x

point for every $1 in all other Card purchases

1

additional point on Amex Travel Online for eligible hotel or car rental bookings

Insurance Benefits

$5,000,000

Emergency medical insurance amount

$500,000

Travel accident insurance amount

$1,000

Hotel burglary insurance

$85,000

Rental car insurance amount

Earn up to 100,000 Membership Rewards® points* – that’s up to $1,000 in value.

Earn 70,000 Membership Rewards® points after spending $10,000 on your Card within your first 3 months as a new Platinum® Cardmember. That’s $700 towards your next flight.

Plus, earn 30,000 points* when you make a purchase between 14 and 17 months of Cardmembership.* That’s $300 towards dinner out with friends.

*Current or former Cardmembers with this Card are not eligible for these offers. Other terms apply.

The Platinum Card isn't your ordinary credit card. Instead, it's a charge card that offers a huge welcome bonus and plenty of impressive statement credits that more than make up for the steep $799 annual fee. The Platinum Card from American Express is a travellers dream thanks to its $100 NEXUS◊ statement credit, , unlimited access to Priority Pass and American Express Global Lounge Network lounges and huge welcome bonus - Earn up to 100,000 Membership Rewards® points* – that’s up to $1,000 in value.

Disclosures

-

Contact American Express for the most up-to-date referral bonus figures.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

Using your American Express credit card to Shop Small® with local small businesses

While most major retailers in Canada accept American Express credit cards, not all small businesses do. American Express is committed to growing its network of small businesses that accept their credit cards, but there is still a chance you’ll find yourself at one of the few retailers that don’t.

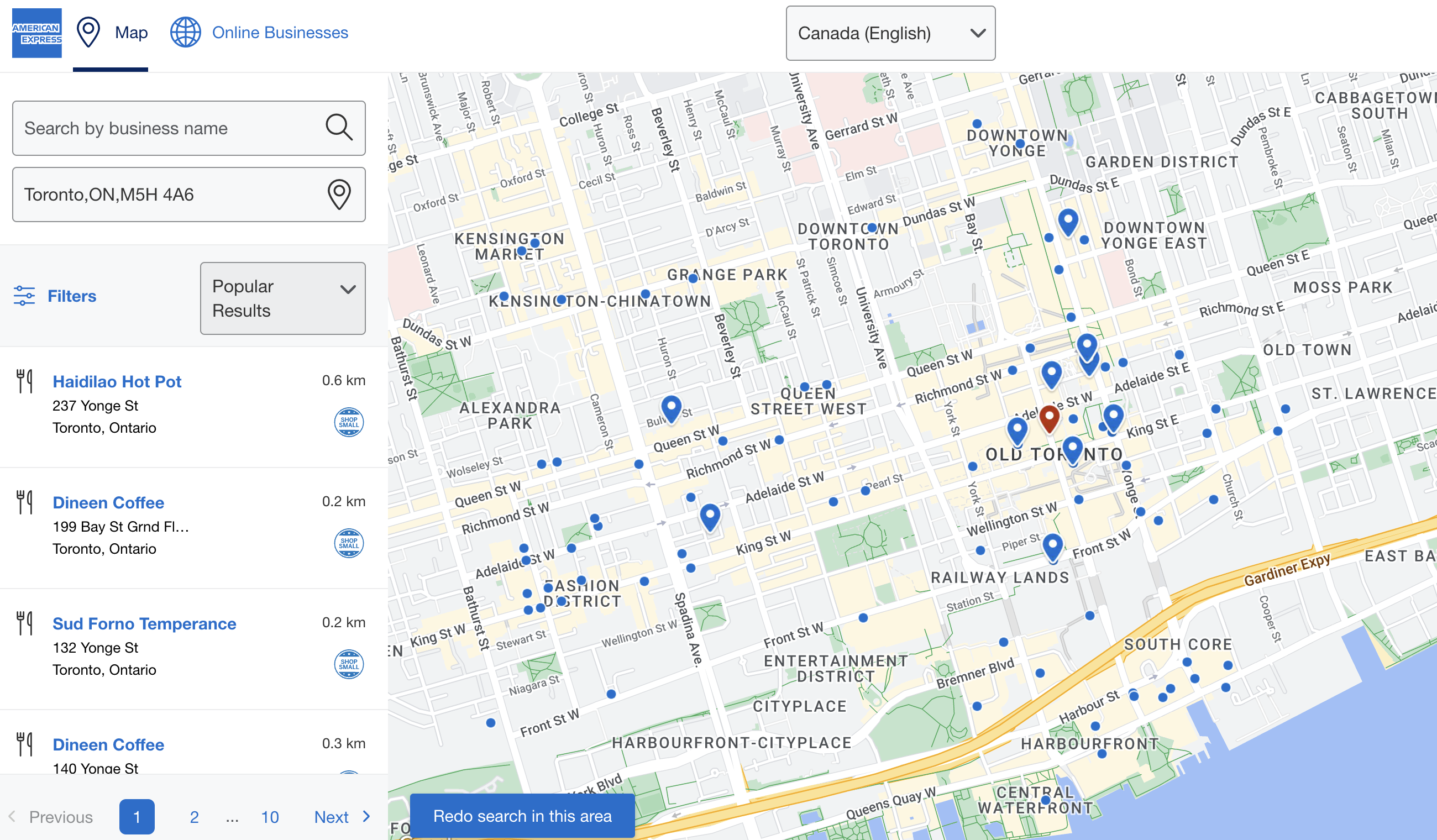

Fortunately, you don’t have to avoid all mom-and-pop stores in your area. To help you determine whether a local retailer will accept your credit card, American Express has built a handy online map that is searchable by location – perfect for when you’re on the hunt for that perfect gift for a loved one.

The bottom line

The reputation American Express credit cards have for being unusable with many retailers is mostly unfounded. Most major retailers accept American Express credit cards, and more and more local retailers are being added to their network every day, small businesses included.

For any shopping necessity, it’s definitely a great idea to have an Amex card fill one of your card slots in your wallet. Use your American Express card to get major bonuses and rewards during the biggest shopping season of the year.

What's next? The best American Express credit cards Canada

-

Contact American Express for the most up-to-date referral bonus figures.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment. - Rates, fees and other information are effective as of January 3, 2025. Subject to change.

-

Conditions Apply. Visit here for the Scotiabank Gold American Express® Card to learn more.

*See Card Provider's website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

FAQs

Cory Santos is a finance writer, editor and credit card expert with nearly a decade of experience in personal finance. Cory joined Wise Publishing from BestCards, with bylines in numerous print and digital publications across North America, including the Miami Herald, St. Louis Post-Dispatch, Debt.ca, AOL, MSN and Medium as well as financial podcasts like KOFE Talk.

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Compare Amex credit cards

Compare other rewards credit cards

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.